Online dating companies could be cheap. They look cheap. Take Match Group for example. Shares of Match trade at roughly 12%+ trailing FCF, a valuation range typically reserved for companies in decline. Or Bumble Inc, which trades at nearly 20%+ trailing FCF! Both are still growing, though barely, in the low-single digits.

Bulls argue that online dating is not going anywhere, and that these companies are priced as if they are melting ice cubes, though to different extents. Your author was once an online dating bull, though my opinion has materially changed since. Essentially, the market is pricing these businesses to be much smaller a few years from now and the key debate is whether such a view is largely warranted. I think it is.

For years, the case for owning dating apps was simple. The market was very underpenetrated (Match Group had 60m+ users compared to their stated TAM of 600m), monetization was very low (minimal relative to annual dating spending, and low relative to other consumer subscription products), and these businesses simply gush free cash flow given modest marketing (primarily Tinder) and capital requirements. Returns on capital are astonishingly good.

The core bear thesis a few years ago was that the inherent user churn would imply that these franchises would have an economic life measured in years, not decades. This was not entirely surprising given that dating apps have far higher monthly churn compared to other consumer apps. Industry experts suggest that 20-30% monthly churn was typical, and Meetic, a French dating app, reported monthly churn in the 10-15% range prior to being acquired by Match Group. 10-30% monthly churn would imply 70-99% annual churn. Essentially, online dating apps have to replace almost their entire user base every year!

So how did these businesses survive? The main reason is due to churn not really being churn, per se. The average behavior of users on dating apps is to get a few matches, hopefully find someone, and delete the app(s).1 Relationships being relationships,2 they don’t always work out, and users reinstall these apps in short order. This behavior is particularly prevalent for Tinder as it has extremely high unaided awareness.3 Basically, while stated churn was enormous, effective churn was likely much lower.4 This is the core reason why the bear thesis was wrong, at least for a few years.

Fast-forward to today, the bear thesis remains (largely) the same. But it is likely to be correct this time. This is because dating app downloads are declining. App downloads are the best leading indicator for dating app unit economics precisely because of the aforementioned churn dynamics. For effective churn to remain significantly lower than stated churn, app downloads need to consistently grow.

Source: Appfigures, AppMagic

And app downloads did consistently grow for a long time. But it recently started declining, and that is disastrous for unit economics. We are a few years removed from COVID so we cannot blame the decline in app downloads to a “COVID overhang.” We are already seeing the effects of declining app downloads. Paying Tinder users have declined at an accelerating pace for the last 2 years, by 5% in 2023 and 7% in 2024. Paying Bumble user growth has sharply decelerated into the negative territory, growing 25% and 12% in 2023 and 2024 but declining 2% q/q in Q4 2024, respectively.

Why have app downloads declined? In my opinion, it is due to high monetization and lack of product innovation. While the focus will be mostly on Tinder, similar arguments could be made for other competing apps such as Bumble, etc.

Source: AppFigures, Blackstone Group, IAC, Spark Networks, Toptal, App Annie, Dating Site Reviews, Match Group

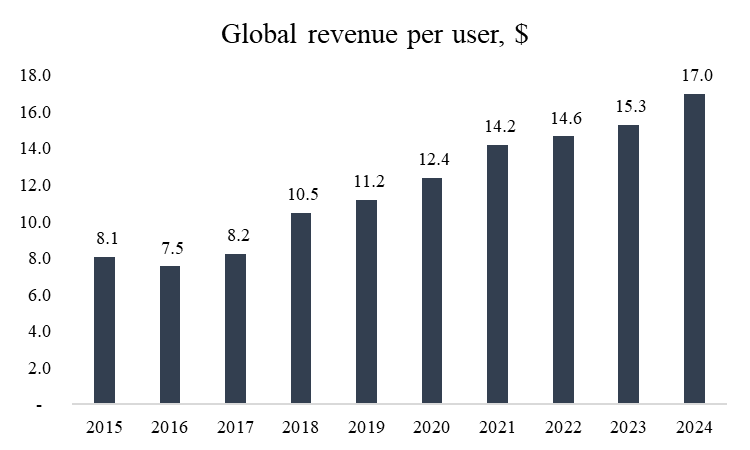

High Monetization: Global revenue per user has more than doubled in the last decade. This has been largely driven by the introduction of various subscription plans with features that in one way or another supposedly increases the number of matches. The prices on these subscription plans have also increased significantly. Tinder Gold launched in 2017 priced at $15-$30 per month in the US, depending on subscription length. This increased to $20-$40 per month during the 2019-2020 period, and in 2023 prices were further increased to $30-$45 per month. Tinder also introduced weekly billing at $17 per week initially. The trend in pricing is similar in other regions. The company justified these price increases based on the introduction of new features for Tinder Gold, including zero ads, “Boost”, “Passport”, “Super Likes”, “Rewind”, etc.

However, an analysis of user reviews relating to Tinder pricing suggests a strongly negative sentiment, with exorbitant pricing being the most common complaint, followed by the perceived lack of value, with many users reporting minimal increase in match quality and quantity compared to the free versions. These are not mere anecdotes. As noted earlier, paying Tinder users have declined materially, and this coincided with a significant increase in revenue per Tinder payer, from $13.8 in 2022 to $16.7 in 2024, representing a 20%+ increase over said period.

Lack of Product Innovation: Below is a list of major feature introductions for Tinder over the past decade.

2015

- Tinder Plus launched (March): Introduced premium features like unlimited matches, Rewind (undo swipes), and Passport (change location).

- Rewind and Super Like introduced: Rewind allows users to reverse swipes, while Super Like signals stronger interest.

- Moments and Last Active retired: These early features were discontinued to streamline the app experience.

2016

- Boost functionality introduced (September/October): Increases profile visibility for 30 minutes, making users one of the top profiles in their area.

- More gender selection options introduced (November): Expanded inclusivity with a broader range of gender identities for user profiles.

2017

- Tinder Online launched (March, globally in September): A web-based version of the app for desktop users, initially tested in select countries (Tinder Blog).

- Tinder Gold subscription launched (August): Allows users to see who liked them before swiping, enhancing match efficiency.

- Tinder Social launched: Enabled group creation for social events, though less prominent and later phased out.

2018

- Tinder University (Tinder U) launched (August): Connects college students on or near campuses, fostering student-specific networking.

2019

- Tinder Lite planned (May): A lightweight app version for markets with limited data or bandwidth, aimed at expanding global reach.

- Swipe Night relaunched (September): An interactive, choose-your-own-adventure series to engage users through storytelling.

2020

- Panic button and anti-catfishing technology enabled (January): Safety features, including Noonlight integration for emergency support, rolled out in the U.S.

- Passport feature made free temporarily (March): Allowed global connections without a subscription during COVID-19 lockdowns.

- Tinder Platinum subscription announced (August): A premium tier with advanced features like prioritized likes and message-before-matching.

2021

- Tinder Made mobile accessories announced (February): Branded physical products like phone cases and apparel.

- Background check service announced (March): Partnered with Garbo to enhance user safety through background checks.

- ID verification service announced (August): Introduced to reduce catfishing by verifying user identities.

- Tinderverse and Tinder Coins testing announced (December): Explored virtual reality (metaverse) and in-app currency for premium services.

2023

- Tinder Matchmaker introduced: Allows friends and family to recommend potential matches, enhancing social trust and safety.

2024

- Explore Tiles launched (February 6): Enables users to discover matches based on shared interests and activities, redefining personalized matchmaking (Tinder Pressroom).

- Tinder U updates (September): Added profile badges (e.g., graduation year, major, clubs) and offered 50% off premium subscriptions for U.S. students (TechCrunch).

2025

- AI Experience Powered by OpenAI launched (April 1): An AI-driven feature to improve user interactions and matchmaking efficiency.

Source: Tinder

While the above timeline may suggest to the reader that there has been significant product innovation, the truth is very different. The vast majority of product introductions have been angles for monetization (Plus, Rewind, Super Like, Boost, Gold, Passport, Platinum, etc) or safety / identification features that likely improved the user experience, but were not game-changing. Having enormous senior management turnover is not ideal either.

Try it for yourself. If you have used Tinder in the past, download it again (with permission from your significant other!), and see if the user experience has changed substantially.

Instead, major product innovations have occurred outside of Tinder. Apps such as Hinge, Bumble, Grindr, and Raya are good examples. While these apps did not fundamentally change the user experience, they were (in my view) major innovations because they had more targeted and focused value propositions that differentiate them from the more “mass market” apps such as Tinder. Hinge focused on meaningful, lasting relationships. Bumble served women. Grindr catered to the LGBTQ+ community, mostly gay men. Raya targeted the rich. To these different demographics, Hinge, Grindr, Raya, etc offers a superior value proposition to Tinder.

It’s All About Downloads

Nevertheless, many of the aforementioned non-Tinder apps have not innovated beyond their differentiated value proposition. The online dating experience has been largely the same for the past decade. Major feature introductions such as video do not appear to be significant needle-movers for the user experience. Most online dating franchises appear to be pinning their hopes on AI to reinvigorate their fortunes. Whether AI is their savior is largely unknown given the nascency of such initiatives.

But the key thing to watch would be app downloads as they serve as the strongest leading indicator for dating app unit economics. If app downloads recover and accelerate, online dating companies such as Match Group and Bumble are extremely cheap. If not, the bears would finally be vindicated.

Users are typically on multiple apps at once.

Or more accurately, situationships, flirtationships, etc., for my millennial / Gen Z readers.

In their S-1, Match Group noted that it owned four of the top five dating brands in North America, measured by unaided awareness. The reader can test this by simply asking any age-appropriate acquaintance to name an online dating app.

The notable exception to these churn dynamics is Grindr, where users are largely on the app for casual relationships. However, their monetization potential is limited as users face the opposite scenario compared to other dating apps; for most it is easy to get matches without the aid of paid features. Hence, Grindr’s paying user penetration is significantly lower than apps such as Tinder.

Disclaimer: The author's reports contain factual statements and opinions. The author derives factual statements from sources which he believes are accurate, but neither they nor the author represent that the facts presented are accurate or complete. Opinions are those of the author and are subject to change without notice. His reports are for informational purposes only and do not offer securities or solicit the offer of securities of any company. The author accepts no liability whatsoever for any direct or consequential loss or damage arising from any use of his reports or their content. The author advises readers to conduct their own due diligence before investing in any companies covered by him. He does not know of each individual's investment objectives, risk appetite, and time horizon. His reports do not constitute as investment advice and are meant for general public consumption. Past performance is not indicative of future performance.

Good write-up. Have you been following Anson Fund's campaign against Match? Wondering if you think the company could benefit from a board refresh.